When it comes to your portfolio, asset allocation (the mix of stocks and bonds you have) is probably the first thing that comes to your mind. But just as important as asset allocation is a different strategy that helps you keep more of your money: asset location.

So what is asset location? It is simply deciding where to put your investments to minimize your lifetime tax bill. Choosing where to place your investments is just as important as what you own. An asset class location strategy can help you boost your after-tax wealth without increasing risk.

Asset Location vs. Asset Allocation

These two terms sound very similar, so let’s clear up what they mean.

- Asset Allocation (what to buy): This is the list of what you want to buy. It should align with your goals and risk tolerance. Many of our clients own 60% stocks and 40% bonds at the beginning of retirement.

- Asset Location (where to put): When you have multiple types of accounts (Roth, Traditional, taxable brokerage), you must decide how to split your investments between them. Many people evenly spread out their investments. For example, if the overall allocation is 60% stocks and 40% bonds, people will invest 60/40 in each account type. But, this is not the strategy that we recommend.

Why Asset Location Matters

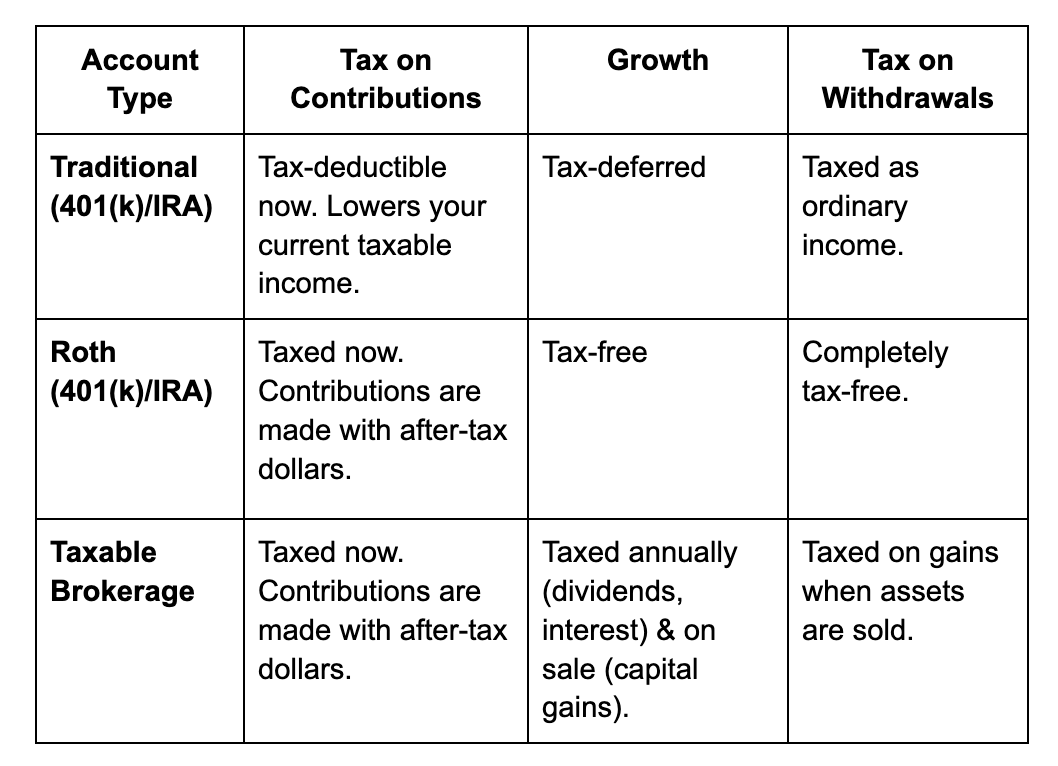

One of the biggest drags on your investment performance is taxes. But, each account is taxed differently. Understanding the taxation of each account type is the key to mastering asset location.

By placing the right investment in the right account, your money grows more effectively, with less taxes eating away at your money.

Asset Location Rules

There are several rules to follow to make sure each investment is in the right account. But, keep in mind that this only applies if you have multiple account types. If you only have a Roth account and it makes sense for you, then keep contributing to it and don’t worry about opening a Traditional or taxable account.

Rule 1: Tax-Inefficient Assets in Tax-Advantaged Accounts

Tax-inefficient assets are those that generate a lot of income, and therefore annual taxes.

- Bonds

- High-Turnover Actively Managed Accounts (high turnover = high income/capital gains)

- REITs (Real Estate Investment Trusts)

Place these assets inside your tax-advantaged accounts (Roth or Traditional 401(k)/IRA). You won’t owe annual taxes inside these accounts and your investments grow without a tax drag.

Rule 2: Tax-Efficient Assets in Taxable Accounts

Tax-efficient assets create lower taxes for you each year.

- Municipal Bonds (tax-free interest)

- Stock Index Funds (low turnover)

If you are lacking space in your tax-advantaged accounts, place these tax-efficient assets in your taxable account so that there is room for the high income producing assets in the tax-advantaged accounts.

Special Rule for Roth Accounts

Since Roth accounts grow completely tax free, you would want to put your highest growth potential assets here (stocks). This way, all the growth will be yours without paying a cent in taxes.

What is Asset Location in Practice?

Let’s consider Jane, who has $100,000 and is saving for retirement. She has a Roth 401(k) worth $60,000, a Traditional 401(k) worth $30,000, and a taxable account worth $10,000 that she will use for retirement. Jane has determined that her proper asset allocation is 60% stocks and 40% bonds. She plans to buy $60,000 of a stock index fund, $30,000 of a bond fund, and $10,000 of a municipal bond fund. In order to maximize asset location and minimize taxes, Jane should fill her Roth 401(k) with the stock fund, her Traditional 401(k) with the bond fund, and her taxable account with the municipal bond fund.

Take Control of Your Taxes

Understanding what asset location is puts you in the driver’s seat. Instead of being reactive and just paying the taxes due each year, you can create a proactive approach where your portfolio is designed to create the least amount of taxes from the start.