Parents are known for investing in their kids’ futures: encouraging good habits, instilling values and skills, and helping them go through life on a path better than their own. But one item often gets overlooked: your children’s retirement. Although it may seem far off, the best time to plan for retirement is always now. Opening a Roth IRA for your child is one of the most impactful financial gifts you can provide. It leverages their greatest asset—time—to build a foundation for lifelong financial independence.

The Unrivaled Power of an Early Start

The single biggest reason to open a Roth IRA for a young person is to harness the magic of tax-free compound interest. Compounding is when your investment earnings begin to earn their own money. And the longer it rolls, the bigger the snowball gets.

Consider this simple scenario:

- Anna invests $2,000 a year from age 16 to age 65 (total investment: $98,000).

- Ben waits and invests $4,000 a year from age 30 to age 65 (total investment: $140,000).

Assuming a hypothetical 10% average annual return, by age 65, Anna—who started early with a much smaller investment—could have over $2.3 million. Ben, despite investing more money, would have less than $1.2 million.

That huge difference is the result of 14 extra years of compounding. Giving a child this head start is like giving them a multi-decade running start toward financial independence. And when they do retire, they will have a big pot of tax-free money.

What is a Roth IRA?

A Roth IRA is a special type of retirement account with a unique tax structure. Here’s the simple breakdown:

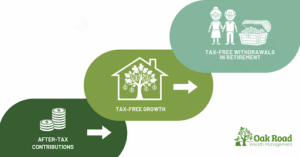

- Post-Tax Contributions: You contribute money that you’ve already paid taxes on.

- Tax-Free Growth: The investments inside the account grow completely tax-free.

- Tax-Free Withdrawals: All withdrawals in retirement (after age 59½) are 100% tax-free.

Think of it like planting a seed (your contribution). You pay a small tax on the seed itself, but the entire tree and all the fruit it produces are yours to keep, tax-free.

How to Get Started

Helping our clients’ next generation is important to us, so please let us know if you plan to take the leap with your kid’s financial future. There are a few key requirements to open and fund a Roth IRA for your child.

The Earned Income Rule

This is the most important rule. A child must have legitimate earned income to be eligible for an IRA. This can be from a traditional W-2 job (like a lifeguard or cashier) or from self-employment (like babysitting and mowing lawns).

Contribution Limits

You can contribute up to the total amount the child earned for the year, with a maximum annual limit set by the IRS. For 2025, the limit is $7,000. So, if your child earns $3,000 from a summer job, they can contribute up to $3,000 to their Roth IRA for that year. The good news is, typically dependents have low enough income that little, if any, of their money gets taxed.

The Custodial Account

For a child under 18, you’ll open a Custodial Roth IRA. You will manage the account until your child reaches age 21 (for Missouri). At that point, control of the account is transferred to them.

Gifting the Contribution

Your child doesn’t have to use their actual work money for the contribution (but they definitely can). As long as they have the earned income on record, you can gift them the money to fund the IRA. This allows them to spend their hard-earned cash while you help them invest for their future.

For Young Adults 18 and Over

If your child is already a legal adult, there is just one difference; a custodial account is no longer needed and they can open a Roth IRA in their own name. Encourage them to start immediately, even if it’s just with $20 or $50 a month. By starting in their late teens or early 20s, they still have an enormous time advantage over their peers. Emphasize that the habit of consistent investing is more important than the amount when they’re just beginning.

By opening a Roth IRA for your child or encouraging your adult child to open one, you’re not just giving them money. You’re giving them the gift of time, financial education, and a future with significantly less financial stress. We understand that the last thing your kid wants is another speech from their parents, so let us help. As another benefit to you, we would be happy to manage a Roth IRA for your child and give them the financial education they need.